Our partners cannot pay us to guarantee favorable reviews of their products or services. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. It focuses on the obligations and considerations faced by brokers and advisers in recommending accounts to retail. So how do we make money? Our partners compensate us. The fiduciary rule, also known as the conflict of interest rule, states advisers have to give conflict-free advice on retirement accounts, putting their. The SEC issued a staff bulletin on March 30, 2022, regarding fiduciary principles.

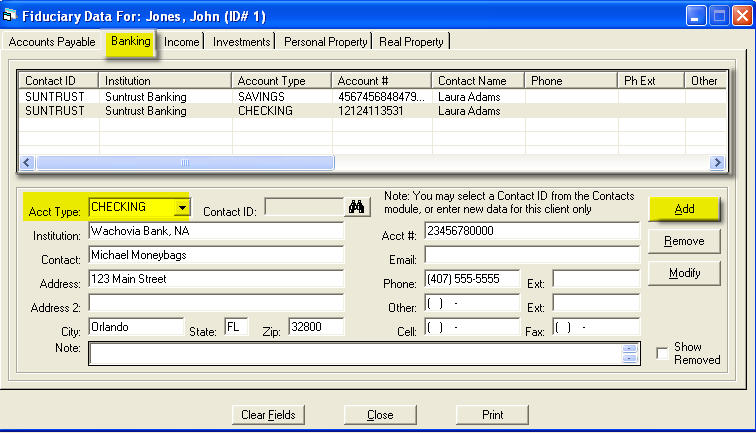

And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward - and free. We believe everyone should be able to make financial decisions with confidence. (e) Fiduciary capacity means: trustee, executor. at bank of america private bank, our trust and investment management relationship with you is supported by the strongest standard of integrity, trust and accountability the fiduciary standard which requires us to act solely in your best interests. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. (d) Fiduciary account means an account administered by a national bank acting in a fiduciary capacity. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. The individual who opens the account doesn’t have ownership of it.

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. A fiduciary deposit account, also known as a principal account, is a deposit account that a person or other entity, acting as a fiduciary, establishes to benefit one or more persons who own the assets in the account, according to FDIC rules. Fiduciary Standards entail always acting in your beneficiarys best interest, even if doing so is contrary to yours. Currently, those who provide financial advice adhere to two standards of conduct: (1) a fiduciary standard for advisers who are registered with the SEC under the Investment Advisers Act of 1940 and (2) a suitability standard for brokers and others that refer to themselves as advisory in nature. They are not intended to provide investment advice. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

is an independent publisher and comparison service, not an investment advisor.

0 kommentar(er)

0 kommentar(er)